Elections and Your Portfolio: Why Long-Term Vision Trumps Short-Term Politics

Are you ready for it? It's coming. You know what I'm talking about, don't you? The question that's about to become the root of a hundred conversations with friends, family, and, yes, your financial advisor:

"What's going to happen to my portfolio if..."

The Republicans win?

The Democrats stay in power?

A third-party candidate shakes things up?

Democracy falls apart?

The oceans rise and locusts swarm while fires consume the earth?

(Okay, maybe that last one is a bit dramatic, but you get the idea.)

As your friendly neighborhood financial advisor, I'm here to tell you something crucial: Politics and investments don't mix. Let me explain why.

Politics and Investments Don’t Mix.

The Emotional Rollercoaster of Politics

We all know that 'feelings' are best avoided when making investment decisions. It doesn't matter how you feel about the market or the economy; you should stay invested. Similarly, political 'feelings' should be avoided like the plague when reviewing investments.

Remember how many people sat in cash (or gold) waiting for Obama to trash the economy? Spoiler alert: He didn't, and stocks did exceptionally well under his tenure. Fast forward to 2016, and we saw the same story with Trump. Those who pulled their stocks out of the market when he entered office missed out on significant gains from 2018-2021.

The lesson? Your portfolio doesn't care who's in the Oval Office.

The Data Doesn't Lie

Let's look at some numbers:

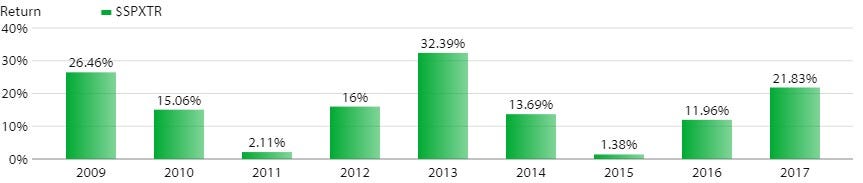

During Obama's presidency, the S&P 500 saw annual returns ranging from 1.38% to a whopping 32.39%.

Under Trump, even with 2020's volatility, annual returns ranged from -4.38% to 31.49%.

It's crucial to note that these figures represent annual returns, not cumulative returns over the entire term. This means that within a single presidential term, the market experienced significant variations from year to year.

Here's the key takeaway: While the market does have its ups and downs on an annual basis, regardless of who's in charge, it's important to remember that, on average, the market goes up more than it goes down. This long-term upward trend is what makes staying invested so crucial.

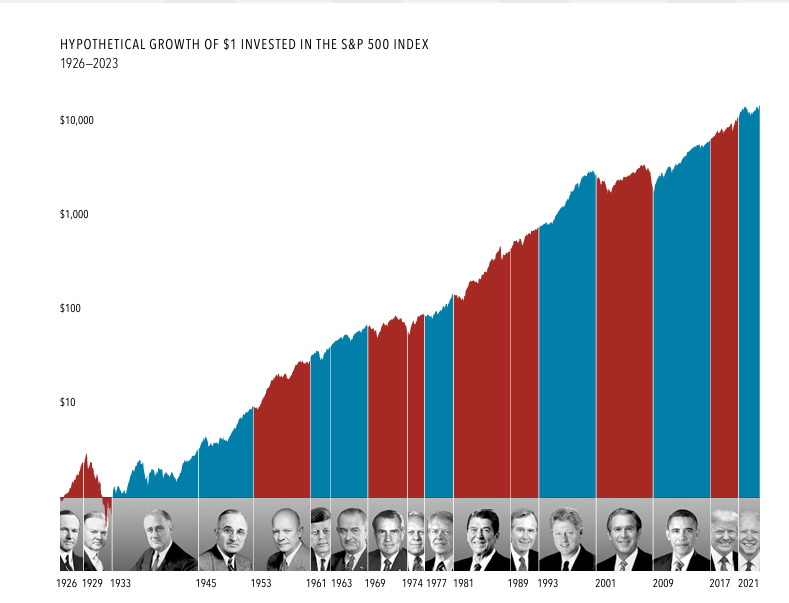

To put this in perspective, let's look at some long-term data. In his seminal work "Stocks for the Long Run," finance professor Jeremy Siegel provides compelling evidence for the superiority of stock investments over extended periods:

Siegel's research shows that from 1802 to 2006, stocks produced a real return (after inflation) of 6.8% per year, compared to 3.5% for long-term government bonds and 1.4% for short-term treasury bills.

Even more striking, Siegel found that over rolling 30-year periods, stocks have never lost money after inflation.

In the most recent edition of his book, Siegel notes that from 1802 to 2012, a broadly diversified portfolio of stocks returned 6.6% per year after inflation, outperforming bonds (3.6%) and gold (1.1%)1.

These findings underscore a crucial point: despite short-term volatility, including periods affected by political changes, the stock market has consistently rewarded patient, long-term investors.

Some years see exceptional growth, others may see declines, but the overall trajectory over extended periods tends to be positive. This historical trend reinforces the importance of maintaining a long-term perspective rather than reacting to short-term political changes or annual fluctuations.

By staying invested, you position yourself to benefit from the market's overall upward movement, smoothing out the impact of those inevitable down years. Remember, it's not about timing the market but time in the market that often leads to success.

Your Portfolio's Long-Term Vision

Here's the crucial point: We're working together to create a lifetime portfolio. Your investment strategy will persist beyond a multitude of presidents, legislative changes, political crises, and global events. We can't shift with every political wind without dramatically altering—and most definitely reducing—your expected lifetime return.

A Script for Success

When you're tempted to ask, "What's going to happen to my portfolio if...," remember this:

These are important questions on a social level, and it's great that you're engaged with these issues.

Your concerns are valid and real.

From the perspective of your financial plan, it's crucial to understand one point: politics and investments don't mix.

Why? Because politics is rife with feelings and emotions—two things we want to avoid when making investment decisions. Your investment portfolio is designed to persist beyond any single political event or administration.

Stay Committed, Stay Focused

I'm not suggesting you stop caring about politics or current events, far from it. I am wholeheartedly suggesting we stay committed to your financial plan despite the constant shifting of political winds.

Remember, your personal fortitude matters. As your advisor, I'm here to embody fortitude and steadfastness. We are committed long-term investors. We live these virtues, and you benefit from our perspective, patience, and optimism.

The Bottom Line

Most investors are nervous or fearful about the state of the world. That's natural. But our job as financial advisors committed to your long-term success isn't to judge these feelings or to commiserate. Our job is to listen, understand, and then gently dissuade you from acting on fear.

This approach sets us apart from many other advisors who, unfortunately, get wrapped up in politics themselves. When financial advisors become distracted by political drama, it can lead them – and consequently, their clients – astray from the path to long-term financial success. We strive to rise above the political fray to keep both ourselves and you focused on what truly matters: your financial well-being and life goals.

Why is this so important? Because our ultimate goal is decades of compounding goodness to achieve your financial dreams. And that, my friends, is a cause worth staying committed to—no matter who's in the White House or what political winds are blowing.

So, the next time you feel the urge to make drastic changes to your portfolio based on election results or political forecasts, take a deep breath. Remember your long-term goals. And if you need reassurance, that's what I'm here for. Let's talk about your concerns and refocus on what really matters: your financial future.

After all, elections are just blips on the radar in the grand scheme of your financial journey. Your sense of purpose and the things in life you value most? Those are your true North Star. Your well-crafted, long-term investment strategy is the vessel that supports and carries you toward those deeply held values and aspirations.

By keeping your focus on what truly matters to you—be it family, community, personal growth, or leaving a lasting legacy—you'll find it easier to navigate the turbulent waters of election cycles and political changes. Built with these values in mind, your investment strategy is the sturdy ship that will weather these storms and keep you on course toward your most meaningful life goals.

Remember, we're not just investing for the sake of seeing numbers grow on a screen. We're investing to support the life you want to live, the impact you want to make, and the legacy you want to leave. That's the real power of purposeful, long-term investing—and no election can change that.

Siegel, Jeremy J. "Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies." 5th Edition, McGraw-Hill Education, 2014.