There’s no award for being the richest person in the graveyard.

The first time I heard that phrase, it immediately hit home. “Financial planners are getting retirement income planning all wrong,” I thought.

“Financial planners are getting retirement income planning all wrong,” I thought.

Traditional retirement income planning focuses on planning for the worst-case scenario. In technical terms, we call that overspending risk or longevity risk.

It’s essentially the risk that you outlive your money rather than the other way around.

This is a serious risk! And it should be considered. Yet, running out of money is extremely rare for retirees with a decent-sized nest egg and a competent financial plan, especially when social security is considered.

You’ll notice that overspending risk comes from a place of scarcity. Our intellectual resources go toward ensuring you don’t run out of money.

Yet, a funny thing happens. By over-concerning ourselves with a singular disaster scenario, we completely ignore another risk: underspending risk.

The Risk of Underspending in Retirement

What’s underspending risk?

It’s the risk that you restrain yourself from spending on items or experiences that would bring you joy for fear of running out of money in retirement.

Most retirees I know want to spend on travel and experiences in their 60s and 70s even as they slow down slightly in their 80s and 90s.

This is affirmed by data. David Blanchett observed what he called The Retirement Smile. The average retiree spends less on an inflation-adjusted basis in their late 70s and early 80s. At some point, inflation-adjusted spending starts to increase again as healthcare expenses increase toward the end of life.

Others have described retirement spending as a hatchet.

In reality, what we tend to see is a retirement distribution "hatchet”, in which the initial retirement distribution rates from a portfolio are highest early in retirement, then significantly decline when deferred Social Security is claimed (as late as age 70) and decline further as spending declines according to a retirement spending smile. (Kitces.com)

The traditional approach to retirement planning fights this tendency. By forcing retirees to underspend and adhere to an overly rigid and simplistic rule like the 4% rule, retirees have less disposable income in their 60s and 70s and more in their 80s and 90s.

In other words, retirees are restrained when they desire income and flush when they potentially have less need for it.

There’s another piece of collateral damage: Due to the failures of retirement income planning, many prospective retirees end up retiring much later than they otherwise would or could have.

Unnecessarily Delaying Retirement

Sometimes, a delayed retirement is matched with a genuine desire to work, and that’s great! Yet, a delayed retirement is a tough pill to swallow when people are burnt out and ready to retire, knowing they could have already been enjoying retirement for a few years.

There is great fear around de-cumulation, that is, spending down your hard-earned savings in retirement. Sometimes there is shame associated with spending as well:

If I had only saved more, I wouldn’t have to worry about this. I could take income while hardly touching my portfolio.

This is where an honest assessment of the numbers and the realities of retirement income planning can help offer various paths forward. Once you are comfortable with the numbers and a prospective spending plan, you may also become comfortable with the prospect of earlier retirement.

And what a joy that is!

After years of trading your time for money, you can flip the switch and start trading your money for time. An earlier retirement may offer more time with loved ones, like family, friends, kids, and grandkids. It’s more time for passion projects, like retooling old cars, writing a novel, volunteering, or philanthropic pursuits. It’s more time for travel and fun activities, like golf, cycling, or pickleball. And it’s more time to relax, rejuvenate, and enjoy the simple pleasure of life, a coffee on the porch, a good book, or an afternoon walk.

How to Safely Target Higher Spending

Most investors tend to live in the ‘income’ paradigm. They believe they will live off the income from their portfolio, like bond interest and stock dividends, in retirement.

Unfortunately, this is a subpar, if not disastrous, philosophy. When solving for income creation, portfolios tend to be overly conservative, with a high fixed-income allocation. This leaves investors at the mercy of inflation and often fails to protect against longevity risk.

In 1994, a researcher named Bill Bengen devised the 4% rule. Bengen’s research concluded that in a worst-case scenario of future market returns, retirees could take out 4% of their portfolio at the beginning of their retirement and increase that amount by inflation annually. The portfolio would provide for 30 years of inflation-protected income.

Bengen has since increased that number from 4% to 4.5%, but the 4% number is more commonly used and referenced.

Sadly, most individuals, including many financial advisors, believe retirement research ended here.

But it didn’t. A great deal of progress has been made since Bengan’s initial research.

For example, in 2004, financial planner and retirement researcher Jonathan Guyton published “Decision Rules and Portfolio Management for Retirees: Is the ‘Safe’ Initial Withdrawal Rate Too Safe?” in FPA Journal.

Guyton devised what he called a Guardrail Approach. Essentially, by putting banded ‘adjustments’ on either side of the annual income amount, monthly income could be increased in good markets and decreased in bad markets.

The latter is incredibly important. Bengen’s 4% rule is static. It acts the same regardless of the market and economic environment. But retirees, like retirement, are dynamic and make thousands of spending decisions every year. If spending needs to be decreased in a lousy economy, they will do so and withdraw less money from their portfolio.

Crucial Point: Retirement is dynamic.

An important aspect of the ‘Guardrail Approach’ is that the starting withdrawal rate could be higher than alternatives because spending may decrease in bad markets or increase in good markets.

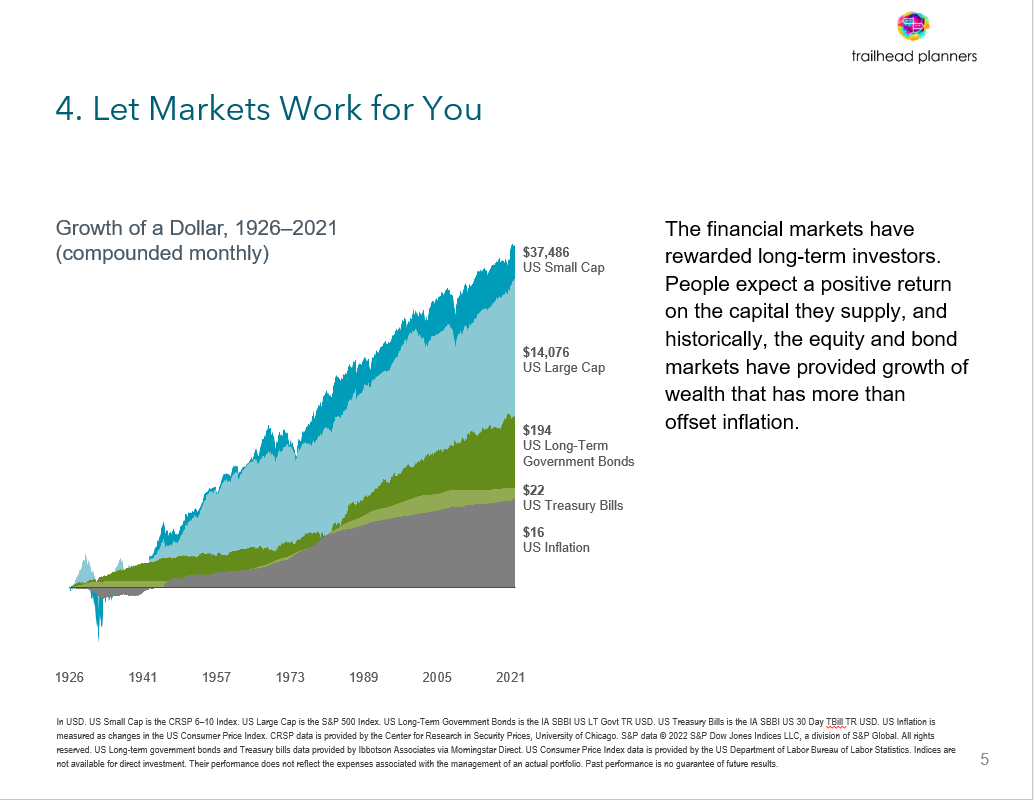

Guyton pointed to 5.8-6.2% as being ‘safe’ initial withdrawal rates depending on the amount allocated to equities. Notably, the higher the allocation to equities, the higher the amount that can be initially withdrawn. The ‘why’ here is obvious: Stocks have historically outperformed bonds dramatically over longer periods of time. In finance, we call this the ‘equity premium.’

Guardrail Math Versus Alternatives

You can see the benefit of a higher initial withdrawal rate immediately.

Let’s say you have a $2,000,000 portfolio and desire $100,000 annually from your portfolio in addition to social security. If you use the 4% rule, you may decide to work for a couple more years to save up an additional $500,000.

0.04*$2,500,000=$100,000

However, a retiree using the Guyton/Guardrail framework could retire immediately, assuming they were comfortable with the framework and its conditions.

This is big stuff!

When we use outdated rules, like the much-referenced 4% rule, many workers end up retiring years later than they could have had they been privy to the latest research on retirement income planning.

Starting Income Amount on a $1,000,000 Portfolio at different withdrawal rates:

4%: $40,000

4.5%: $45,000

5.2%: $52,000

5.8%: $58,000

6.2%: $62,000

I don’t know about you, but if the higher withdrawal rate doesn’t dramatically increase retirement risk, an extra $12,000, $18,000, or even $22,000 annually sounds nice.

What could you do with an extra $1,000/month? $1,500?

Could you travel more? Keep your second home? Eat out with friends a few times a month (and then some)? Golf more?

Could you worry about money less?

Please note that following the guidelines of Guyton’s research is challenging. There are a lot of rules to follow when settling on the initial withdrawal rate and how to adjust the rate in the future. Please consult your financial advisor before implementing any strategies noted in this post1.

Other Advancements in Retirement Income

There have been other advancements in retirement income. For example, a new technical innovation is using ‘Probability-of-Success-Driven Guardrails.’ My firm, Trailhead Planners, uses a variation of this methodology.

Essentially, this retirement income analysis combines the straightforward methodology of guardrails with Monte Carlo statistical analysis (i.e., probability of success).

It is certainly a more complex method, but it allows us to be more precise and thorough in our analysis.

Justin Fitzpatrick, the founder of Income Lab, our retirement cash flow projection software, has this to say about retirement income:

Risk in retirement is often presented as the risk of catastrophe. An advisor recently asked if you would get on a plane if you knew there were a 5% chance of a crash. No? Then why would you accept a 5% chance of failure in retirement?

This framing of risk is fundamentally flawed. Typically, if retirees “fail” to achieve the income they had hoped for, they don’t run out of money. They don’t experience financial ruin. They adjust — just as they would have during their working years.

Retirement risk is better than the chances that your flight will be delayed or even canceled. Historically, small adjustments would have saved almost any reasonable retirement plan. Downward income adjustments are inconvenient — maybe even painful. But they don’t mean financial ruin. You will still reach your destination. → Source: Think Advisor

Fitzpatrick’s core point is crucial: The risk with retirement income planning isn’t the risk of failure (i.e., running out of money). It is the risk of adjustment.

Retirement income planning is more about the risk of adjustment rather than the risk of failure.

What are the tradeoffs?

In financial planning, it’s always best to think about tradeoffs. As I often say, “You can have everything you want but can’t have it all at once.”

What are the tradeoffs to spending more in retirement?

A dynamic spending plan that addresses underspending risks needs regular monitoring and semi-regular adjustments.

The higher your initial withdrawal rate, the higher the risk you must take a negative adjustment in your withdrawals. In other words, you must be emotionally and financially prepared for small pay cuts during poor market environments.

A dynamic spending plan often demands more sophisticated planning. Some retirees who are both competent and passionately interested in retirement planning may be able to do their own planning. Most retirees should seek professional help from a qualified and fiduciary financial planner.

Retirees hoping to spend more (or give more) must be comfortable with stock market volatility. There is an inherent tension between short-term financial security and long-term financial security. The latter, being far more critical, demands the growth and inflation-beating properties of a diversified portfolio of great companies.

Other Factors to Consider

What other factors must you consider when devising your retirement income plan?

A good start would be to consider the following:

Spending Goals: What experiences or things would you like to spend money on now or in the future? How do we fund this?

Legacy goals: How much money, if any, would you like to leave for heirs or charitable causes?

Lifetime giving and gifting: Would you like to gift money to loved ones or charitable causes throughout retirement?

Taxes: Minimizing taxes with thoughtful tax planning can increase the net amount you can spend and/or give throughout retirement and beyond.

Investments: Your investment plan, essentially how your portfolio is allocated, impacts lifetime spending and giving.

Commitment to the Plan: Sticking with the plan through thick and thin.

Summary

Retirees often underspend throughout their retirement years due to concerns about longevity or market risks and a dated approach to retirement income planning.

Retirees who are open to a dynamic approach, like guardrails or Probability-of-Success-Driven Guardrails, may be able to spend more, especially during their 60s and 70s, when they are most capable of enjoying higher spending. They also may be able to retiree earlier, which is an incredible gift of time for individuals ready for something new.

Longevity risk, market risk, and other financial risks are important considerations for any competent financial plan. However, don’t forget underspending risk.

Remember, the success of your financial plan isn’t defined by how much you have at the end. It’s about what author Brian Portnoy calls, Funded Contentment. Your financial resources should allow you to securely and confidently invest in the fullness of life.

Key Takeaways for Your Retirement Plan

A healthy retirement plan balances underspending risk with longevity risk

The investment strategy should include a large allocation to equities for their higher expected returns versus cash and bonds to fund higher income in retirement.

Spending, like life, is dynamic. Your retirement plan should follow suit, as a dynamic withdrawal policy usually leads to better outcomes than a rigid withdrawal plan.

Your retirement plan should speak to the fact that most retirees want to spend more on experiences in their 60s and 70s.

Preferably, you work with a financial advisor fluent in comprehensive retirement planning who can help you think through tradeoffs with your income or withdrawal plan.

Wow! So insightful. Written gold. Thanks for sharing, Morgan. You are right the risk of underspending is never considered. We can always make adjustments to the plan.